The Complete History of Blockchain & Web3

In 2008, while the world was grappling with the financial crisis, a quiet revolution was brewing. This wasn’t a revolution in the streets or even in corporate boardrooms. It was happening online, in cryptic forums, among a handful of idealists.

They imagined a financial system free from intermediaries, built on trustless protocols rather than banks. At the heart of it all was Bitcoin, a digital currency introduced by a pseudonymous creator, Satoshi Nakamoto.

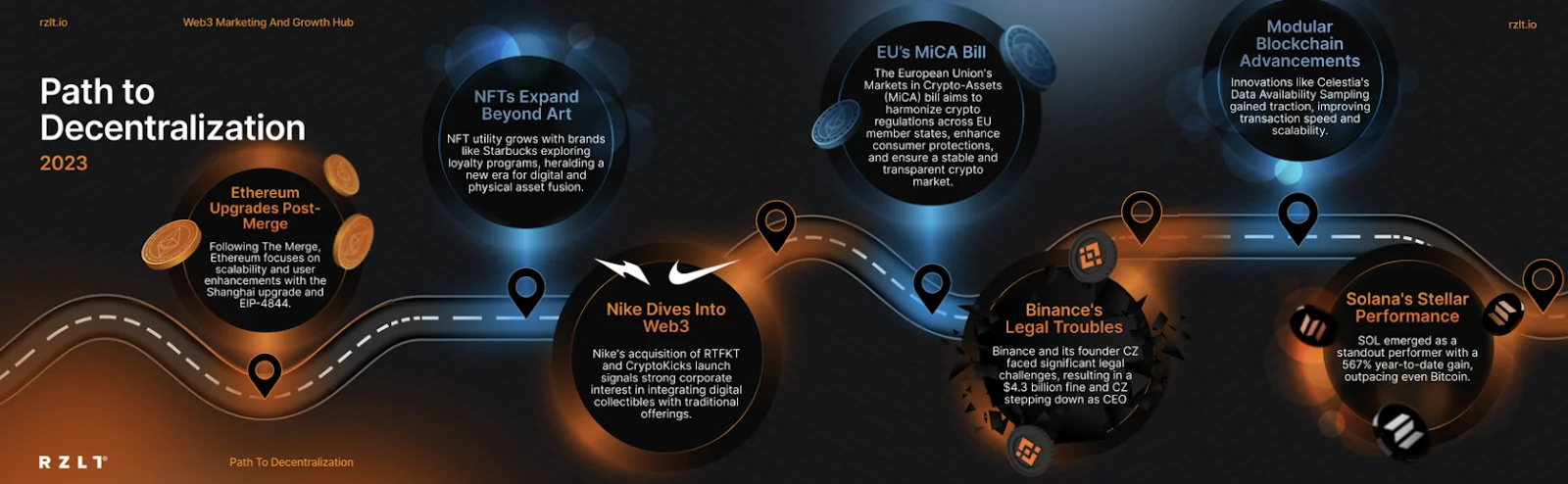

Path to Decentralization

What began as a whisper in the internet backrooms quickly became a movement. Sixteen years later, blockchain technology has upended traditional finance, introduced new forms of ownership, and redefined what it means to control your assets.

Here’s how it all unfolded year by year.

2008–2009: Humble Beginnings

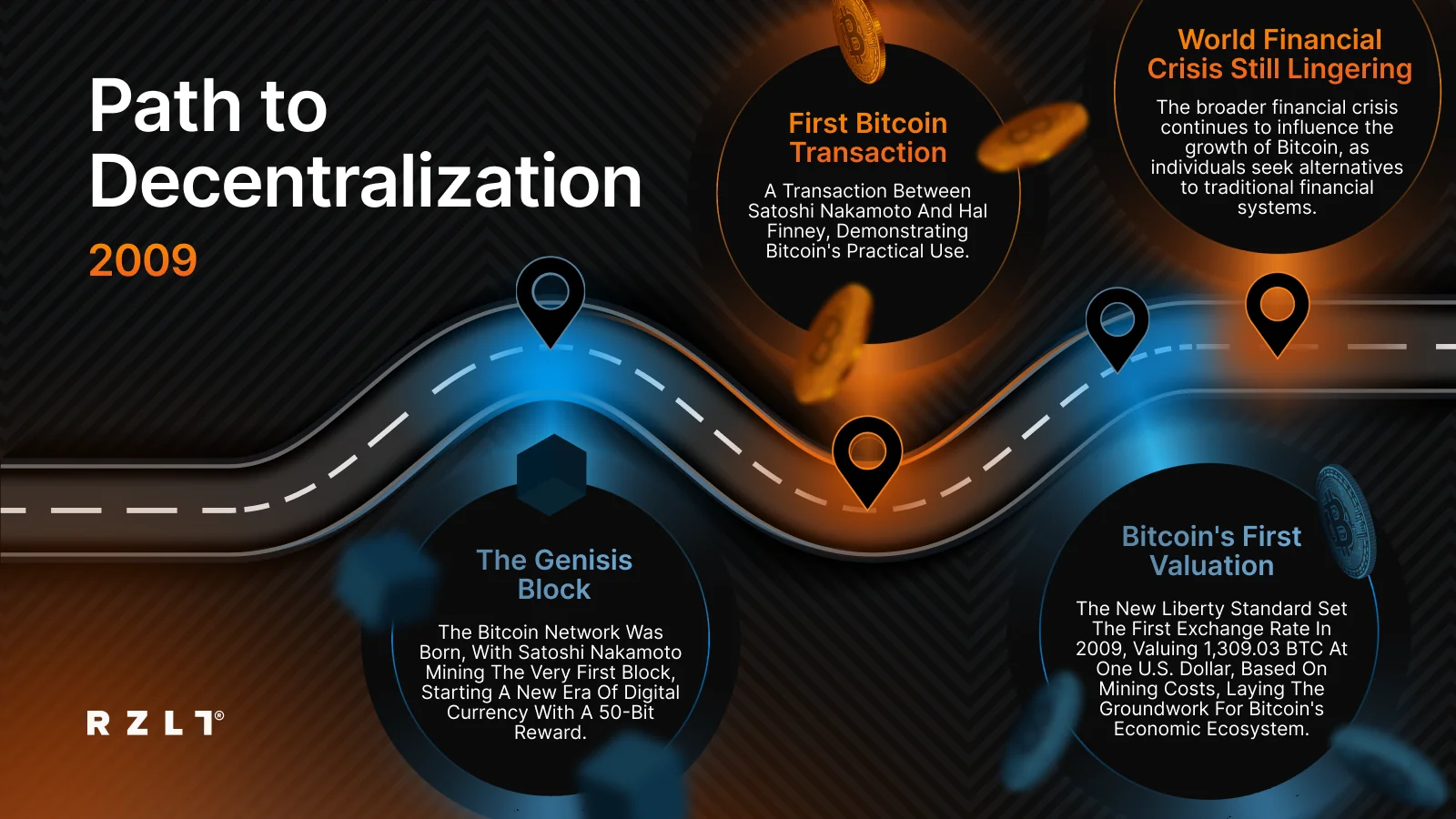

The financial crisis was a breaking point. As institutions failed and governments looked for solutions, Satoshi published the Bitcoin white paper, where he outlined a peer-to-peer electronic cash system. Bitcoin’s promise was simple but radical: erase the need for intermediaries and put financial control directly into people’s hands.

By 2009, this vision became tangible. Nakamoto mined the Genesis Block of the Bitcoin blockchain, embedding a now-iconic headline from The Times: “Chancellor on brink of second bailout for banks.” It was a statement symbolizing rejection of the status quo and a call to rethink money itself.

The Most Popular Pizza of 2010

In May 2010, BTC stepped out of the theoretical into the real world when a programmer traded 10k BTC for 2 pizzas. At the time, it was an arbitrary, quirky internet money and no one was really using it. But that moment, albeit not perceived as historical at the time, has become legendary. We all know those 10k BTC are worth millions now, reflecting the overtime success of the idea.

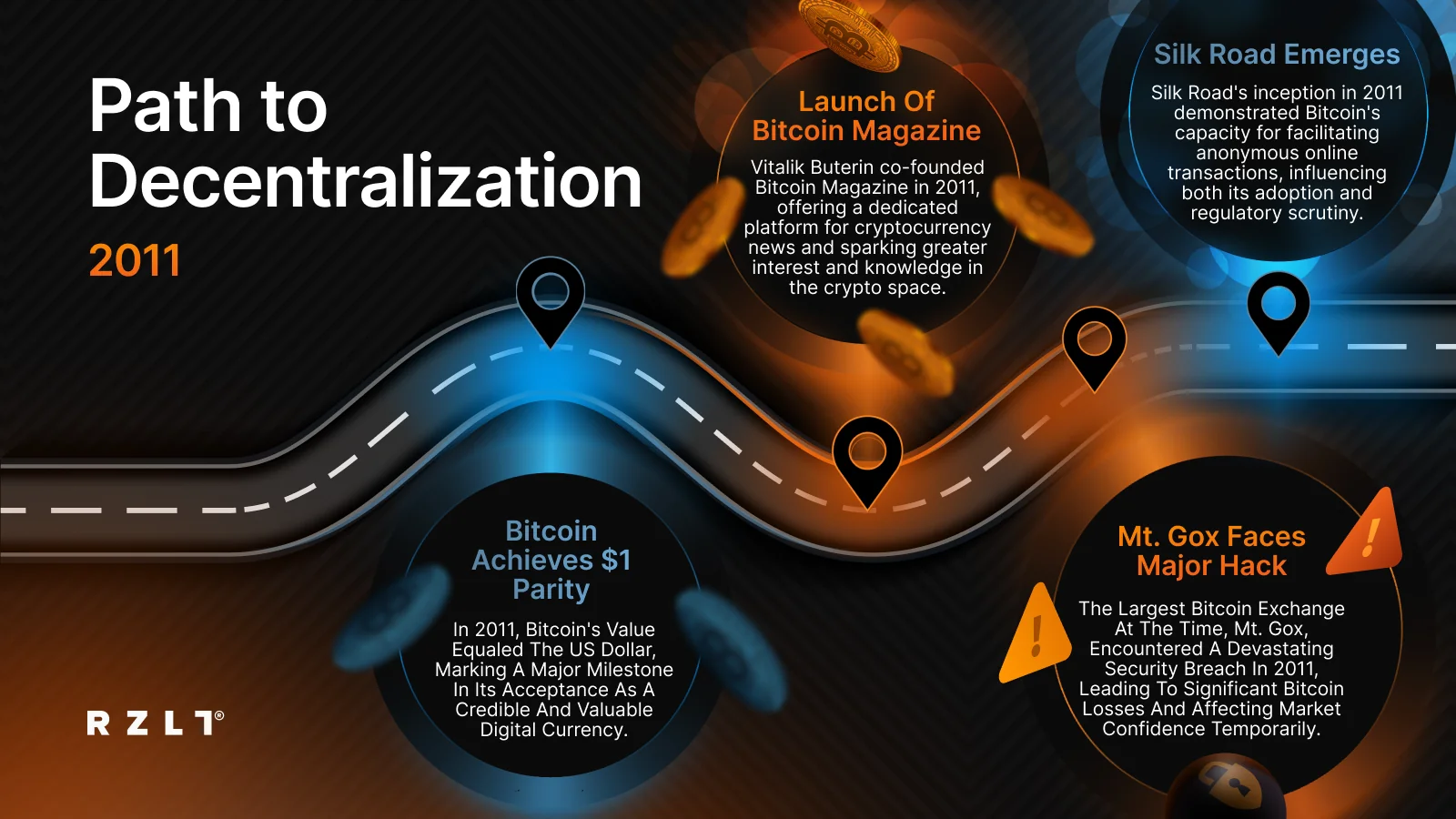

2011: A Mighty Dollar

BTC started gaining some momentum and crossed a significant milestone in 2011: $1 per coin. The once-niche project began catching the world’s attention. Early adopters started to get into its philosophy and potential, and more people started talking about this “decentralized money”.

Vitalik Buterin, a teenager at the time, co-founded Bitcoin Magazine, which became one of the first publications dedicated to the crypto space. This was one of the first efforts to bring people together around crypto and lay the ground for a thriving ecosystem we see today.

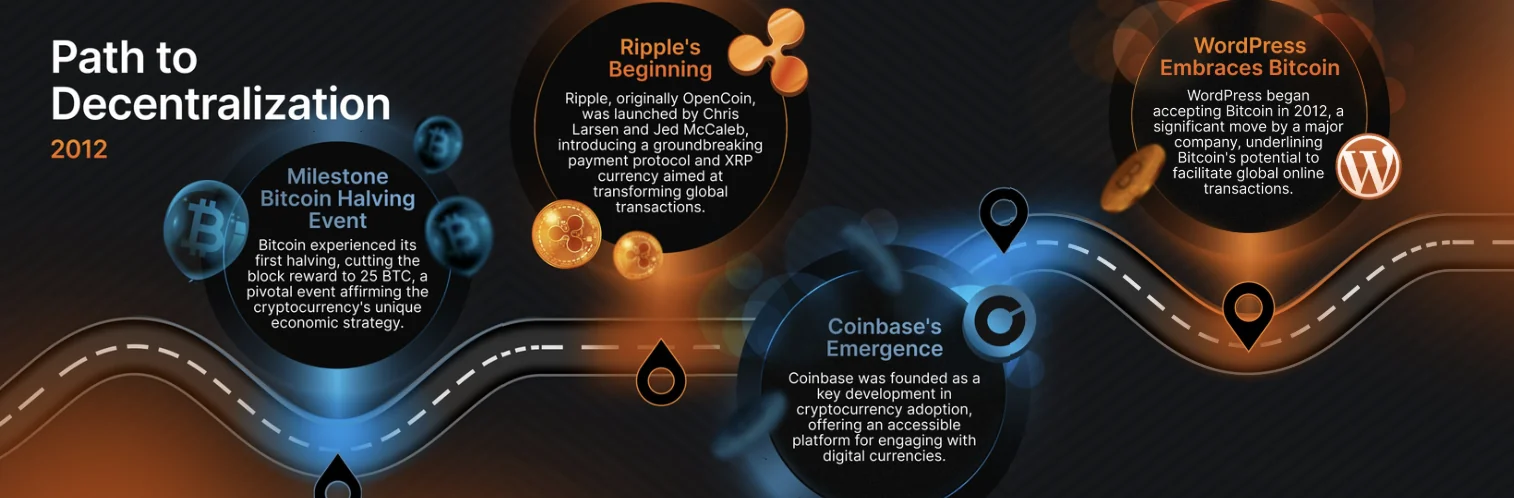

2012–2013: Halving and Expanding

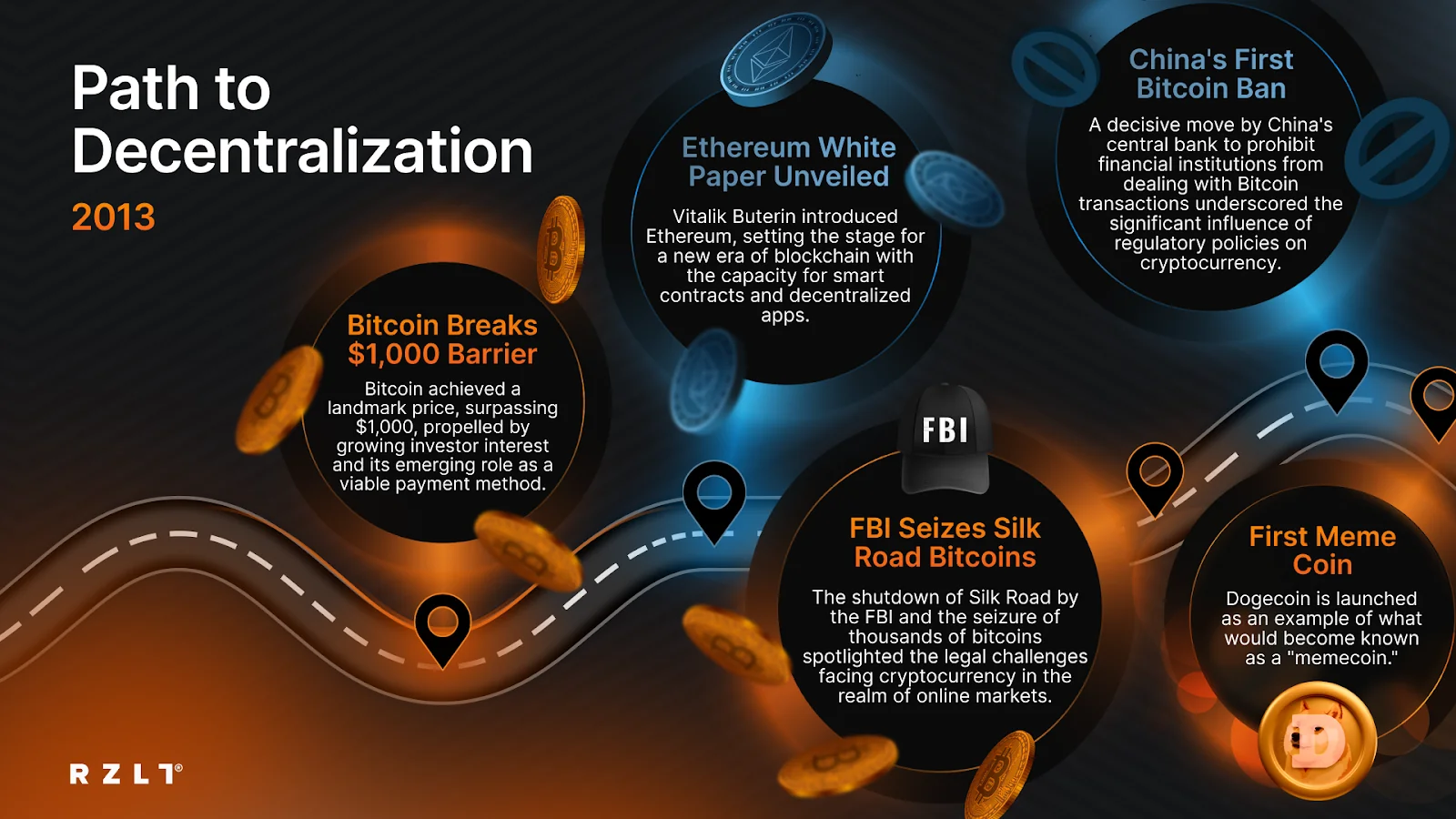

Bitcoin’s first halving was the first experiment of the kind—no one previously knew what kind of consequences it may have. That same year, Coinbase launched, making Bitcoin more accessible to everyday users. Companies like WordPress began accepting Bitcoin, which proved that utility is not only a speculation but can be achieved.

By 2013, BTC’s price faced rapid growth, jumping to $1000+ but not without challenges. China’s central bank restricted Bitcoin transactions, signaling the first of many regulatory battles. Amid this turbulence, 19-year-old Vitalik Buterin introduced the Ethereum white paper, imagining a blockchain capable of more than just transactions. Ethereum’s idea of smart contracts opened a new Pandora’s box of possibilities and creativity.

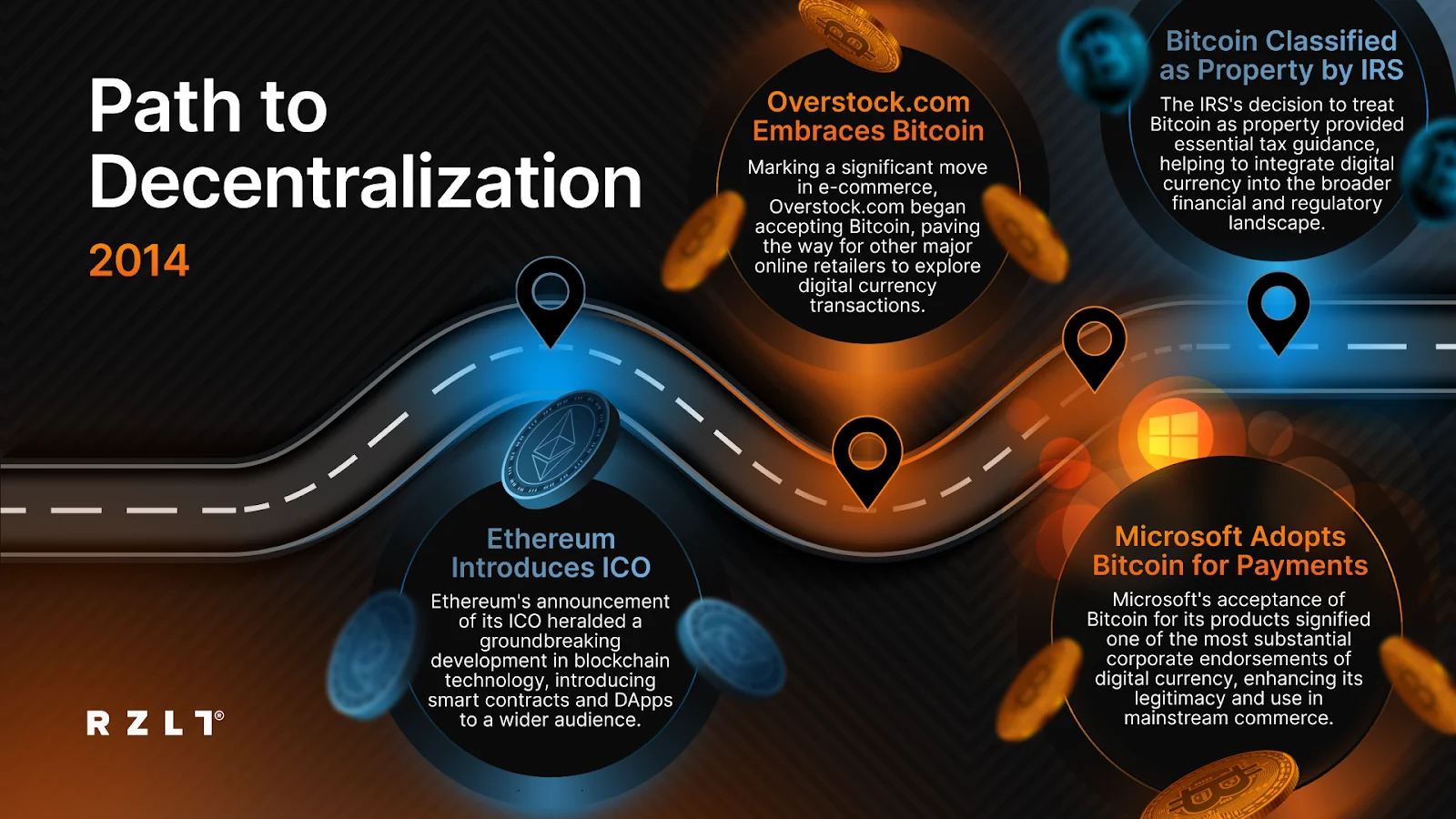

Growing Pains of 2014-2015

With usage and experimentation come errors and mishaps as learning experiences. The same goes for crypto. The first major crisis of 2014 when Mt. Gox lost 850,000 BTC signalized the need for better security and transparency.

Despite this, Ethereum’s ICO inspired devs worldwide. Ethereum’s blockchain went live, bringing smart contracts to life. Microsoft began accepting Bitcoin, and Tether launched, quietly popularizing the concept of stablecoins. At the same time, regulatory clarity improved as Bitcoin was classified as a commodity in the U.S., and Europe made BTC transactions VAT-free, and Coinbase launched the first regulated U.S. exchange.

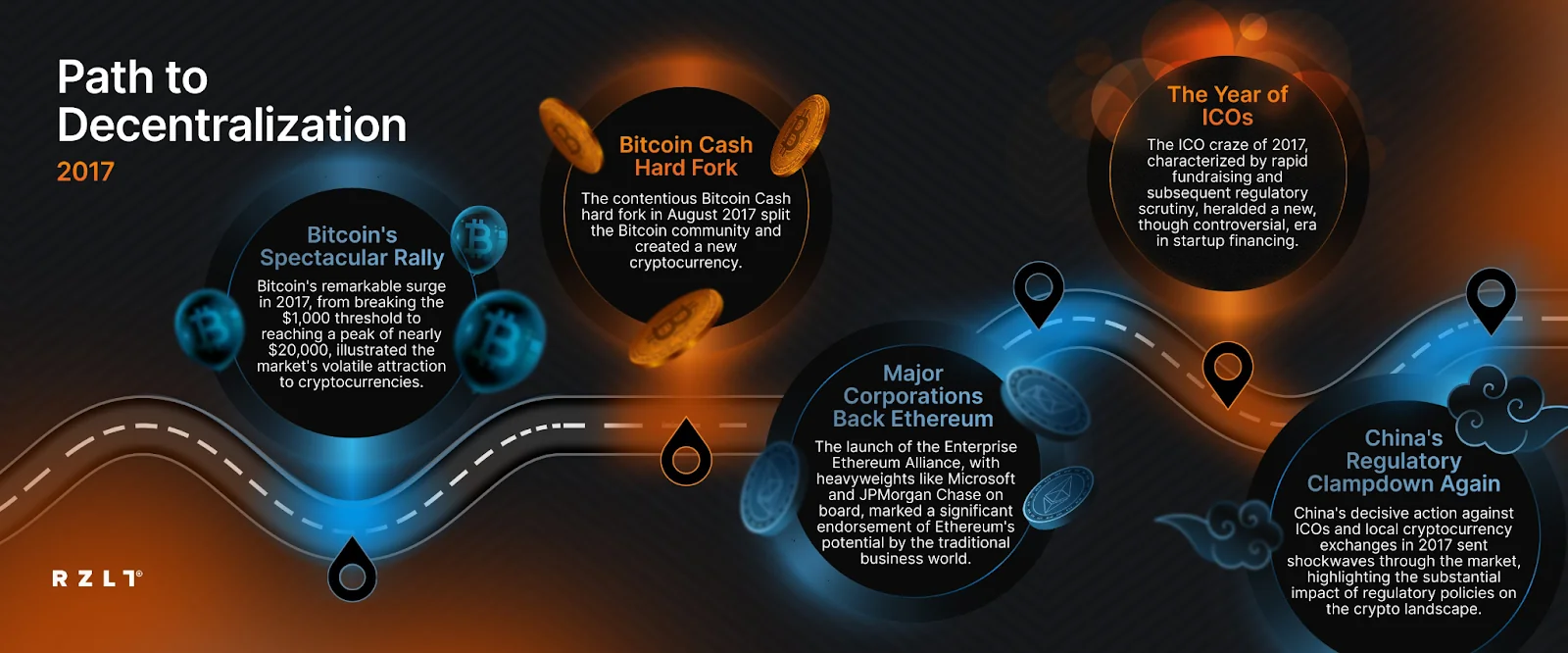

Testing Resilience in 2016 & 2017

In 2016, the DAO hack resulted in a split within the Ethereum community, creating ETH and ETC (Ethereum Classic). Despite these challenges, the industry grew stronger. Privacy-focused projects like Zcash gained traction and the crypto market caught fire. Bitcoin underwent its second halving.

The first results of halving were so impactful that it set the post-halving narrative for the future. BTC’s price skyrocketed from $1,000 to nearly $20,000 putting BTC in the spotlight. Around that time, ICOs raised millions, fueling innovation and controversy. Ethereum gained institutional support, with companies like Microsoft and JPMorgan joining the Enterprise Ethereum Alliance.

The Crypto Winter of 2018

After the highs of 2017, 2018 brought a hard reality check. Bitcoin’s price fell considerably and dragged the entire market into a long bear phase. Tech giants like Facebook and Google banned crypto ads. Reason: concerns over scams.

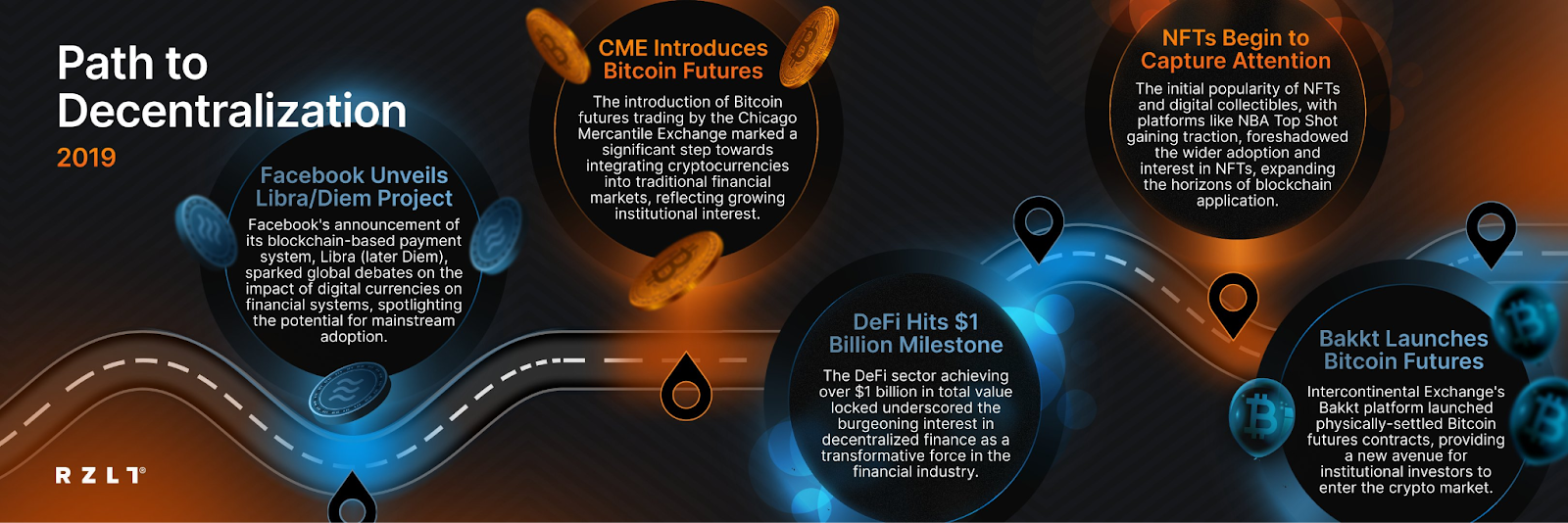

Yet, even in this downturn, the progress continued. Malta positioned itself as a blockchain hub with forward-thinking regulations, and Bakkt’s launch signaled growing institutional interest. The seeds of DeFi and NFTs were quietly being sown, further inspiring people of new use cases.

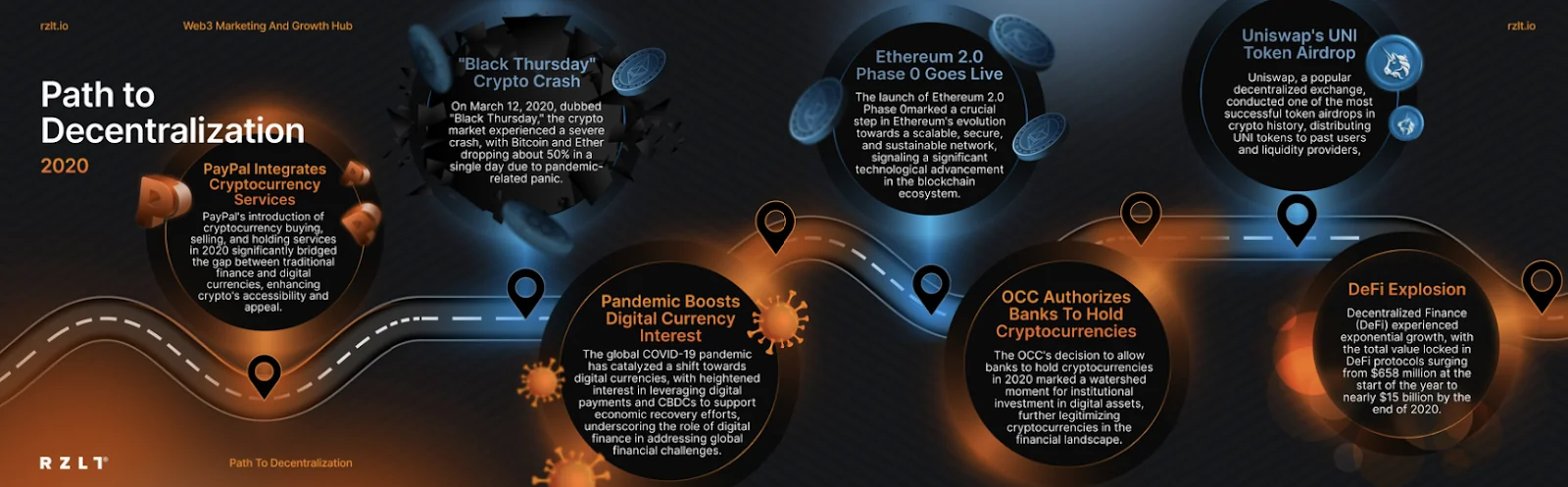

2019-2021: New Possibilities

In 2019, Facebook’s Libra project set off global debates about the future of money. BTC Futures became a popular topic, and DeFi surpassed $1 billion in TVL, giving people more financial freedom. Meanwhile, NFTs began gaining momentum with platforms like NBA Top Shot.

The pandemic in 2020 accelerated digital adoption. PayPal integrated crypto, making it accessible to millions. DeFi exploded, growing from $658 million to $15 billion in TVL. Ethereum experienced a major upgrade with 2.0, and Bitcoin’s resilience through “Black Thursday” set its role as a store of value.

2021–2024: A Period of Mainstream Acceptance

These years made crypto a household name. In 2021, El Salvador made Bitcoin legal tender, and NFTs entered the mainstream, with Beeple’s digital art selling for $69 million.

By 2022, the “crypto winter” tested the industry’s resilience. The collapse of major platforms like Terra and FTX shook many, but Ethereum’s Merge proved the community’s ability to survive, adapt, and be creative along the way.

In 2023 and 2024, the industry regained momentum. Ethereum’s Shanghai upgrade improved scalability, and Bitcoin ETFs were finally approved.

As 2024 closes, we’re seeing BTC crossing $100,000! Quite a symbolic milestone that stands as a symbol of how far the industry has come. What has started as an experimental idea has steadily been growing into a movement changing how we value money, build communities, and have fun.

Conclusion

Blockchain’s story is one of grit, creativity, and a shared dream of a more open and fair financial system. Led by two crypto giants, every milestone in the industry brought us closer to a future of financial freedom.

As we enter 2025, let’s take a moment to appreciate how far we’ve come and keep pushing forward, building something even better, together.

Continue to stay inspired during the holidays with us—subscribe to our newsletter for more stories, insights, and educational content. The journey isn’t over, and we’d love to have you along!